The Supreme Court on Wednesday reserved its order on the issue of whether royalty levied by the central government on mines and mineral-bearing lands since 1989 will be refunded to the states.

Will Centre Refund Royalty On Minerals To States? Supreme Court Reserves Order

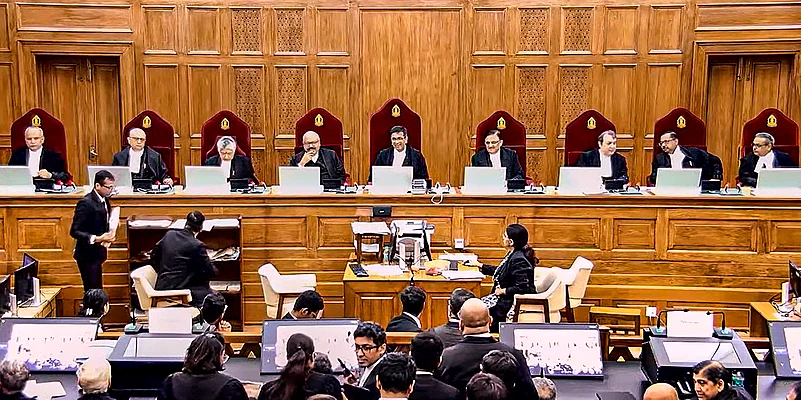

In an 8:1 verdict on July 25, a nine-judge Supreme Court Constitution bench held that royalty payable on minerals is "not tax". The Supreme Court majority verdict held that states have legislative competence to impose tax on mines and minerals-bearing lands under the Constitution.

In an 8:1 verdict on July 25, a nine-judge Supreme Court Constitution bench held that royalty payable on minerals is "not tax". The Supreme Court majority verdict held that states have legislative competence to impose tax on mines and minerals-bearing lands under the Constitution.

The nine-judge bench which delivered the judgement was headed by CJI DY Chandrachud and comprised Justices Hrishikesh Roy, Abhay Oka, BV Nagarathna, JB Pardiwala, Manoj Misra, Ujjal Bhuyan, SC Sharma and AG Masih.

Chief Justice of India (CJI) DY Chandrachud said Justice BV Nagarathna delivered a dissenting verdict on whether royalty payable on minerals is tax. The majority verdict said that the 1989 judgment of its seven-judge Constitution bench, which held that royalty on minerals is tax, is incorrect.

The Centre opposed the plea of the mineral-rich states seeking refund of the royalty levied by it on mines and mineral-bearing land since 1989, saying any such order asking it to pay the alleged dues with retrospective effect will have a "multipolar” impact.

Senior advocate Rakesh Dwivedi, appearing for Jharkhand mineral development authority, urged the court to make the July 25 verdict retrospective and direct for refund of the royalty in a staggered manner

The July 25 verdict gave a huge revenue boost to mineral-rich states, however, led to the dispute with regard to the operation of the verdict.

Some opposition-ruled mineral-bearing states urged the top court to make the verdict operational with retrospective effect so that they can seek refund of royalty from the Centre.

However, the Centre opposes any such order saying it will have a "multipolar impact.

Many firms involved in mining activities also support the Centre’s view on refund of royalty to mineral-bearing states.

The Solicitor General said states like Madhya Pradesh and Rajasthan, which are ruled by the BJP, wanted the judgement to be made applicable prospectively, a news agency PTI report said.

-

Previous Story

Uniform Civil Code 'Unacceptable', 'Discriminatory': All India Muslim Personal Law Board Rejects UCC

Uniform Civil Code 'Unacceptable', 'Discriminatory': All India Muslim Personal Law Board Rejects UCC - Next Story